https://newrepublic.com/post/205206/donald-trump-panics-supreme-court-tariff-ruling

WE’RE SCREWED”: Trump Panics Over Looming Supreme Court Tariff Ruling

Donald Trump warned what would happen if the Supreme Court overturns his tariffs.

The Supreme Court could undo the president’s “Liberation Day” tariffs in as few as two days—and Donald Trump is not taking the countdown well.

The nation’s highest judiciary did not issue its tariff ruling last week, as it widely had been expected to do. That surprised markets, forcing them into a holding pattern as the question of the legality of Trump’s tariffs—which were enacted through provisions under the International Emergency Economic Powers Act—remained in doubt.

It’s not clear when the Supreme Court will issue its ruling on the tariffs, but the decision could be released in the next wave of court judgments on Wednesday, a reality that has apparently spent the president spinning.

In a lengthy rant on Truth Social Monday, Trump claimed that the U.S. would have to “pay back … Hundreds of Billions of Dollars” to the countries and companies that pledged to invest in American factories and plants in order to avoid his tariffs if the Supreme Court determined his economic action was unlawful.

“When these Investments are added, we are talking about Trillions of Dollars!” Trump wrote. “It would be a complete mess, and almost impossible for our country to pay.”

He then tried to shift blame for the hastily constructed tariff plan—which was built on bad math—onto the judiciary. He claimed that the nine-justice bench would be at fault for the fallout of the plan rather than his office, which forced it through in April against the advice of at least two dozen Nobel Prize–winning economists.

“Anybody who says that it can be quickly and easily done would be making a false, inaccurate, or totally misunderstood answer to this very large and complex question,” Trump continued. “It may not be possible but, if it were, it would be Dollars that would be so large that it would take many years to figure out what number we are talking about and even, who, when, and where, to pay.

“Remember, when America shines brightly, the World shines brightly,” he concluded. “In other words, if the Supreme Court rules against the United States of America on this National Security bonanza, WE’RE SCREWED!”

Trump Is on Revenge Path Now That James Comey Case Has Fallen Apart

Yet another prosecutor has been fired for refusing to go after the former FBI director.

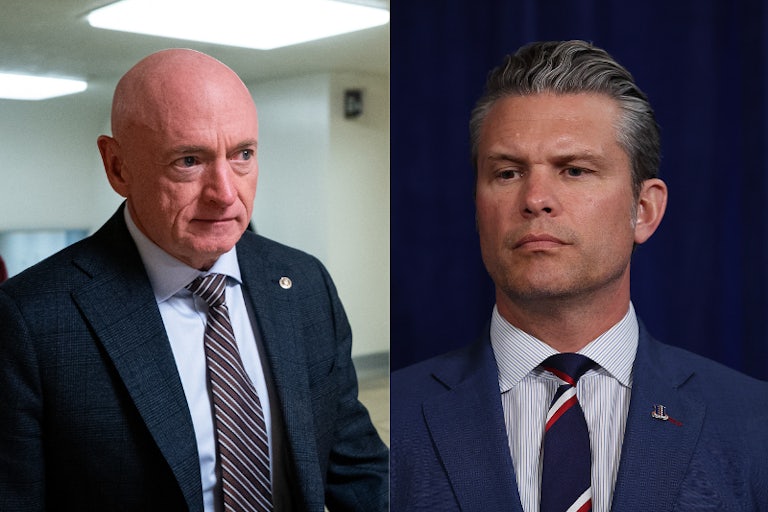

Mark Kelly Hits Defense Secretary Hegseth With Major Lawsuit

The Democratic senator is suing Hegseth over his attempts to censure him.

Senator Mark Kelly has decided enough is enough with Secretary of Defense Pete Hegseth and filed a lawsuit against him in federal court Monday.

Kelly sued Hegseth, the Defense Department, Secretary of the Navy John Phelan, and the U.S. Department of the Navy over Hegseth’s attempts to punish the Arizona senator. Hegseth has censured Kelly and moved to reduce his retirement grade and military pension after he appeared in a video message in November with other former service members in Congress advising military personnel to refuse to follow illegal orders from the Trump administration.

In his lawsuit, Kelly alleges that Hegseth and the others violated his First Amendment and due process rights, claiming that the Trump administration’s actions “trample on protections the Constitution singles out as essential to legislative independence.”

“It appears that never in our nation’s history has the Executive Branch imposed military sanctions on a Member of Congress for engaging in disfavored political speech. Allowing that unprecedented step here would invert the constitutional structure by subordinating the Legislative Branch to executive discipline and chilling congressional oversight of the armed forces,” the lawsuit states.

Kelly noted that after President Trump accused him of committing treason and sedition, Hegseth immediately echoed those accusations and moved to punish Kelly without due process.

“The Constitution does not permit the government to announce the verdict in advance and then subject Senator Kelly or anyone else to a nominal process designed only to fulfill it,” Kelly said in the lawsuit.

Hegseth is attempting to punish a sitting member of the Senate for criticizing the president, which already goes against the Constitution and separation of powers, something Kelly highlighted in his lawsuit.

Will this lawsuit force Hegseth and Trump to see how absurd it is to punish members of Congress for their speech? At the very least, it may well embarrass the White House in federal court.

This story has been updated.

Two GOP Senators Vow to Fight Trump’s Federal Reserve Takeover

Donald Trump has launched an unprecedented attack on Federal Reserve Chair Jerome Powell, and on the very independence of the central bank.

At least two Republican senators plan to fight back after the Department of Justice opened a criminal investigation into Federal Reserve Chair Jerome Powell over the weekend, vowing to block all of President Trump’s nominations to the central bank.

Senator Lisa Murkowski said Monday on X, “After speaking with Chair Powell this morning, it’s clear the administration’s investigation is nothing more than an attempt at coercion.

“If the Department of Justice believes an investigation into Chair Powell is warranted based on project cost overruns—which are not unusual—then Congress needs to investigate the Department of Justice. The stakes are too high to look the other way: if the Federal Reserve loses its independence, the stability of our markets and the broader economy will suffer,” Murkowski added. “My colleague, Senator Tillis, is right in blocking any Federal Reserve nominees until this is resolved.”

Thom Tillis, a member of the Senate Banking Committee who will retire at the end of his term this year, has vowed to block all of the Trump administration’s Fed nominees until the Department of Justice backs off from its investigation into Powell and other Fed officials.

“It is now the independence and credibility of the Department of Justice that are in question. I will oppose the confirmation of any nominee for the Fed—including the upcoming Fed Chair vacancy—until this legal matter is fully resolved,” Tillis posted on X Sunday. The Senate Banking Committee has a narrow 13–11 advantage for Republicans, meaning that his opposition would stall any of Trump’s picks.

Powell sounded the alarm over the DOJ’s investigation into himself Sunday, saying that the independence of the financial body was at stake over “the administration’s threats and ongoing pressure.” Now it seems that some Republicans agree. The question is whether Trump will back down or still try to strong-arm Powell and the Fed.

Trump Refuses to Learn His Lesson on Letitia James

Maybe this time will be the charm for Donald Trump?

The Trump administration is giving its investigation into New York Attorney General Letitia James another shot.

The president shared a New York Post report to his Truth Social page Sunday night, effectively affirming that federal prosecutors are working toward more potential charges against James.

This case seemingly accuses James of alleged campaign misconduct over a total of $36,000 that her campaign paid to Iyesata Marsh, her longtime hairdresser, between 2018 and 2019. Roughly $22,000 of the payments were intended as payment for James’s use of Marsh’s studio as a late-stage campaign office in the last quarter of the year, according to a 2019 Wall Street Journal report.

The New York Times reported that prosecutors sought to speak with Marsh about the payments after she herself was indicted and charged with bank fraud and identity theft regarding the purchase of a Land Rover several years ago.

New York’s top cop has become one of the president’s chief legal adversaries since Donald Trump’s bank fraud case, when James successfully proved Trump was guilty of lying to banks. He was ordered to cough up nearly half a billion dollars in 2024—but has yet to do so.

In April, the Trump administration launched an investigation into James’s personal finances, accusing the attorney general of lying on her bank statements in order to obtain better mortgage rates. At the time, Trump referred to James as a “totally corrupt politician” and a “wacky crook,” and accused New York’s first Black woman in statewide office of being “racist.”

But that case completely fell apart in November, when a judge ruled that the administration had improperly appointed the lead attorney, Lindsey Halligan, who had no prosecutorial experience at all. Halligan’s predecessor, Erik Siebert, was squeezed out of his position overseeing the legal matters of the Eastern District of Virginia after he revealed he couldn’t find incriminating evidence to substantiate Trump’s case against James.

The Justice Department has since tried—and failed—two more times to prosecute James. But Trump’s latest efforts may be a dud thanks to the loud mouths of some of his own staff: In December, White House chief of staff Susie Wiles fessed to Vanity Fair that the president’s flimsy charges against James were his “one retribution,” an admission that would give James’s legal defense plenty of reason to toss his cases against her for eternity.

“We Killed That Lesbian B*tch”: ICE Uses Renee Good’s Death as Threat

Protesters are recounting federal agents using Good’s death to warn them off.

Federal immigration officers have started using Renee Good’s death to threaten more U.S. citizens.

A video posted to Reddit showed a screaming ICE agent repeatedly threatening to kill a man who was sitting in his car, asking how he didn’t “learn from what just happened.”

In the two-minute clip, a masked agent wearing a Minnesota Timberwolves hat approached the vehicle already furious, while the driver rolled down his window. “Stop fucking following us, you are impeding operations, this is the United States federal government,” the officer shouted.

“I live over here, I got to get to my house,” the driver replied calmly.

“This is your warning, alright? Go home to your kids, go home to your kids. This is your last warning. I won’t arrest you,” the officer threatened, before stomping away.

When the driver tried to engage another agent on the other side of his car, the agent urged him not to “make a bad decision.”

“I’m not making any bad decision, I’m peaceful. I serve the Lord, not a draft-dodging coward,” the driver said.

“You’re not gonna like the outcome of this, sir. I guarantee you that,” the first officer said, circling back. “I guarantee you’re not gonna like the outcome. Go home to your children. It’s Sunday. It is Sunday. You did not learn from what just happened?”

“Learn what?” the driver asked, but the officer did not elaborate, and the group of federal agents appeared to leave without arresting anyone.

It seems clear, however, that the agent was referring to Renee Good, the U.S. citizen who was shot multiple times by an ICE agent last week after federal officers surrounded her vehicle. While the Trump administration initially justified the deadly use of force by claiming Good was a “domestic terrorist,” President Donald Trump most recently claimed her death was the result of being “disrespectful” of law enforcement.

It’s evident that the driver in the latest video hadn’t done anything illegal because none of the agents made the slightest effort to detain him. In fact, the officer seemed to suggest that even if he could, he wouldn’t actually arrest him—he would just kill him.

This isn’t the only time that ICE agents have apparently invoked Good’s killing.

Another protester, who identified themself as a former U.S. Marine, claimed in an interview posted on X that federal officers had mocked Good while violently arresting them. “They said, ‘Have you not learned? This is why we killed that lesbian bitch!’” the protester said.

Scott Olson/Getty Images

Scott Olson/Getty Images